Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Investing truck downpayment

- Thread starter Bulldog0156

- Start date

TakeABreakAndTouchGrass

Well-known member

- Joined

- Sep 19, 2016

- Messages

- 3,239

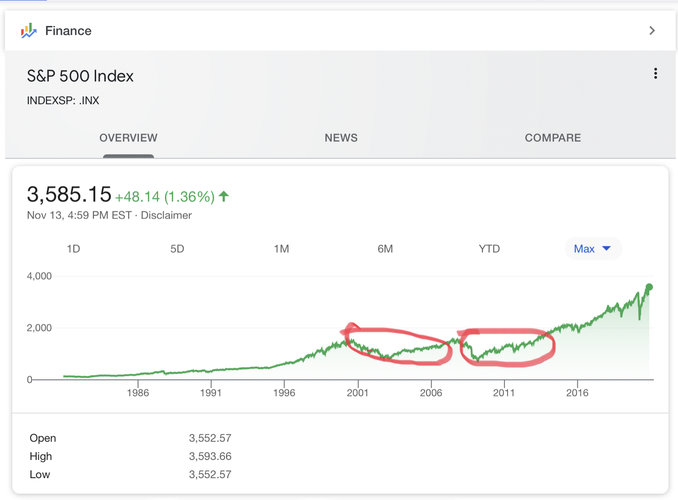

Or, you know, this....Unless something like this happens... But no worries, it’s only 14 out of the last 20 years.

View attachment 162164

I'm not trying to be a prick, but I did say you had to have some appetite for risk. And there are many other options instead of the S&P

RobG

Well-known member

Well, you succeeded even if you didn’t try. Risk means risk of loss no matter how tough your stomach is.

For some perspective on safe returns, if you have $5000 invested at 1% you are making about $4/month (before taxes). i like the idea of figuring out how much your payment will be and saving that each month. $500/month is $6000/year.

For some perspective on safe returns, if you have $5000 invested at 1% you are making about $4/month (before taxes). i like the idea of figuring out how much your payment will be and saving that each month. $500/month is $6000/year.

Wildabeest

Well-known member

I don’t disagree. But one’s appetite for risk needs to adjust based on the duration and time certainty of the need to use those funds for other things. If I know that I’m going to need that money in exactly 3 years, then my tolerance for risk is much lower than if I need it in 20 or 30 years for retirement and drawing it down over a long period of time vs. cashing out the whole thing at once. If the OP had been making this decision at the peak in ‘99-‘00, then he’d have been under water on it until ‘08. Not that the end of 2020 looks like a peak or anything...I'm not trying to be a prick, but I did say you had to have some appetite for risk. And there are many other options instead of the S&P

TakeABreakAndTouchGrass

Well-known member

- Joined

- Sep 19, 2016

- Messages

- 3,239

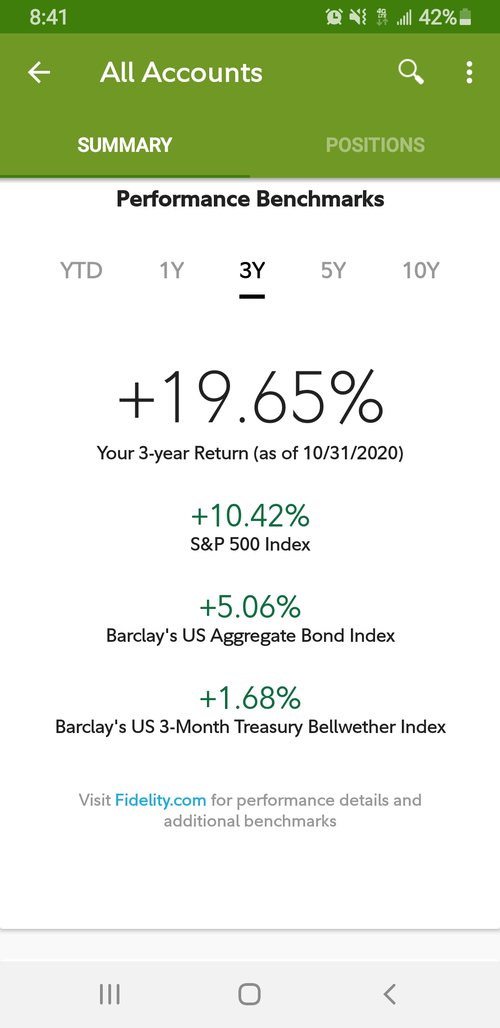

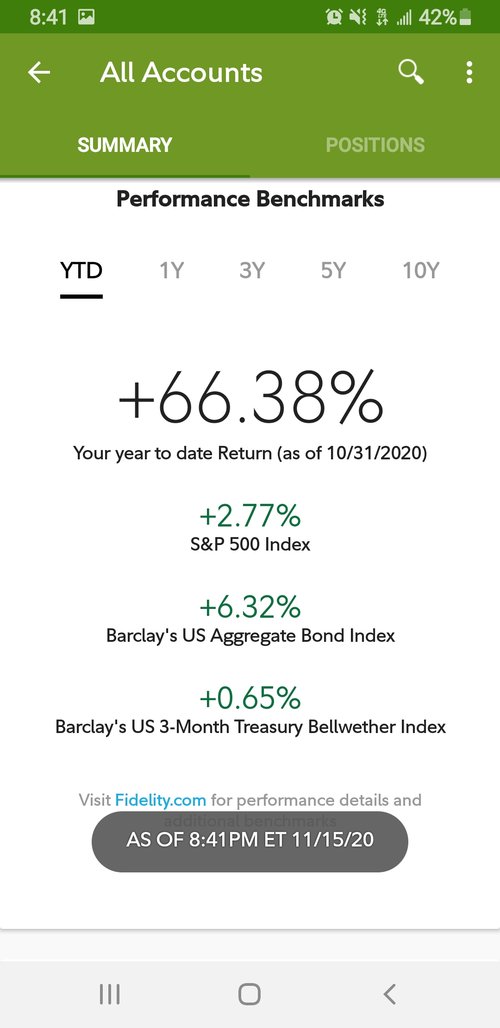

Sure, and if he'd have just chucked it all behind AAPL or AMZN a year ago he would doubled his money.I don’t disagree. But one’s appetite for risk needs to adjust based on the duration and time certainty of the need to use those funds for other things. If I know that I’m going to need that money in exactly 3 years, then my tolerance for risk is much lower than if I need it in 20 or 30 years for retirement and drawing it down over a long period of time vs. cashing out the whole thing at once. If the OP had been making this decision at the peak in ‘99-‘00, then he’d have been under water on it until ‘08. Not that the end of 2020 looks like a peak or anything...

There are a thousand hypotheticals. My main point was that checking, savings, and CD are poor investment tools if you actually want to make enough money on your money to be worthwhile. But, as we have all said, it comes at a risk. Maybe you invest right before the dot com bust, maybe you throw it all behind TSLA at the right time and have 10x your money in less than a year.

Or you just research and invest in some middle of the road ETF that has an average return of 5%. There are some pretty conservative options out there too. It's not all boom or bust.

SAJ-99

Well-known member

This decision in 2000 would have been different. The 3mo Bill rate was over 5% so your money at least kept its purchasing power. Today the yield curve skews the decision-making process (that is the point of the Fed's 0% interest rates). You also have to keep in mind that if the market sells off, prices on cars and trucks will decline and there will be a lot of incentives from dealers. You might be able to buy a new truck and finance it for 0% for 3 or 5 years.Unless something like this happens... But no worries, it’s only 14 out of the last 20 years.

Very hard to play what-if scenarios in this case. The end result is slightly different for a truck purchase than it is for paying for the kid's college. You can keep driving the old truck. It is hard to defer college. The real variable is the individual's job and how stable the income is.

Similar threads

- Replies

- 5

- Views

- 697

- Replies

- 45

- Views

- 1K

- Replies

- 75

- Views

- 4K