SAJ-99

Well-known member

Listening to a guy that says he is an expert because he went through the last housing crisis (when he was like 15) might not be the best idea…you know, financially speaking. But not advice.Everyone loves graphs……..

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Listening to a guy that says he is an expert because he went through the last housing crisis (when he was like 15) might not be the best idea…you know, financially speaking. But not advice.Everyone loves graphs……..

How old are you, if you don't mind me asking? Also, are you an "expert" on anything?Listening to a guy that says he is an expert because he went through the last housing crisis (when he was like 15) might not be the best idea…you know, financially speaking. But not advice.

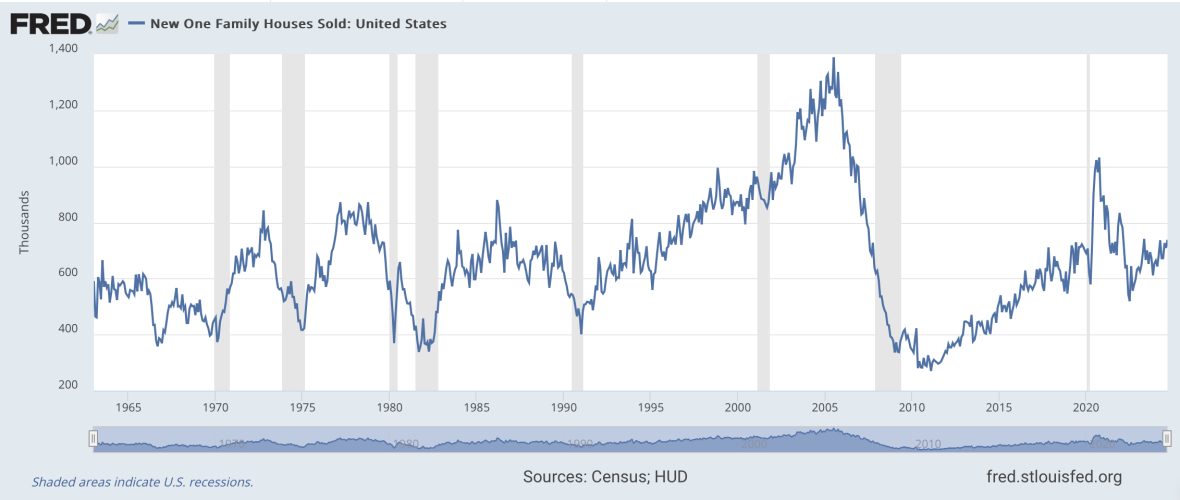

None of that matters. But I'm good at knowing when to ask more questions on a chart. No one is doubting the price decline, but it is New homes only, and builders show a lot more flexibility in pricing. You also need a volume chart, like below. Builders were complicit in the previous housing crisis by overbuilding. In this cycle they have been underbuilding. There is no comparison. If prices collapse this time, it will be for different reasons.How old are you, if you don't mind me asking? Also, are you an "expert" on anything?

From 2920 to current that chart pretty much mirrors interest rates. Well doesn't mirror because it's opposite. Help me out with the big words here.None of that matters. But I'm good at knowing when to ask more questions on a chart. No one is doubting the price decline, but it is New homes only, and builders show a lot more flexibility in pricing. You also need a volume chart, like below. Builders were complicit in the previous housing crisis by overbuilding. In this cycle they have been underbuilding. There is no comparison. If prices collapse this time, it will be for different reasons.

But yeah, I am annoyed by the trend of people rooting against the prosperity of the USofA.

View attachment 348518

Exactly. And that was what the Fed was targeting in raising rates. Explaining that doesn’t generate page views like the phrases “bursting bubbles” and “crash”.From 2920 to current that chart pretty much mirrors interest rates. Well doesn't mirror because it's opposite. Help me out with the big words here.

If I had a dollar for everyone of those videos or headlines I've seen for the last 4 years. Not saying it couldn't happen. It just hasn't.bursting bubbles” and “crash”.

You and me both. There is a chart in there on real price appreciation (price gain above inflation) and it sure looks stretched over the last 20 yrs, but I don't know it signals anything to come. Maybe housing just treads water versus inflation for the next decade? The dynamics of age demographics and the housing shortage make it hard to see a decline.I sure hope and anticipate the housing market continues it's themed trend following inflation. Likely one of the common denominators of common inflation.

"Only 24% of homes purchased at the moment are bought by first-time homebuyers. This is the lowest level on record..."

Using SA's general source:

Housing Becoming Unaffordable for First-Time Homebuyers - Apollo Academy

Only 24% of homes purchased at the moment are bought by first-time homebuyers. This is the lowest level on record,...www.apolloacademy.com

"I remember when steamboat rides were a nickel. All I could afford to do was run up and down the river bank hollerin' ain't that cheap.""I remember when land was a dollar an acre, and no one had a dollar."

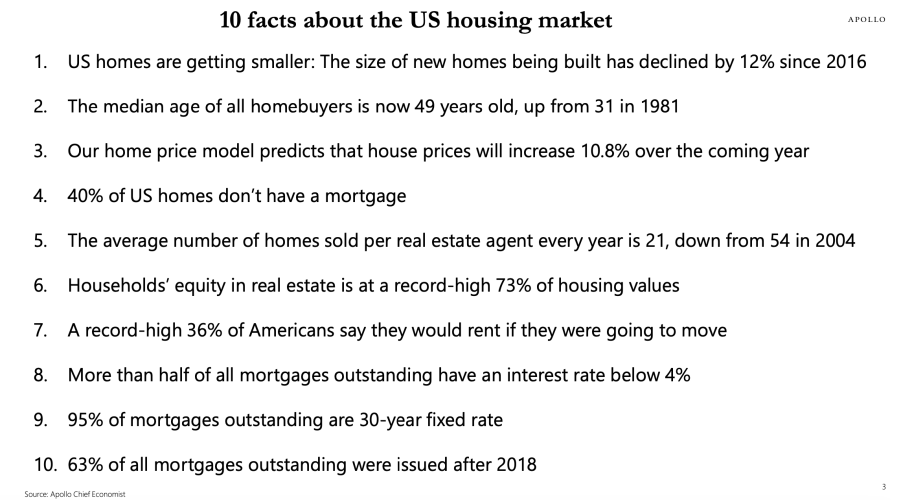

40% of homes don't have a mortgage.For those that care about data, this is an extensive report on the state of the housing market.

The TLDR highlights

View attachment 351812

Estimated shortage of homes at 2.4m

A lot of the stuff we already know - low inventory, low affordability, etc.

If you are looking for something showing a coming housing price crash, it isn't in this data. Housing is at the top of the list of drivers of the US economy and no one benefits if the prices to go down.

Loading…

www.apolloacademy.com

Lot of boomers with a lot of houses.40% of homes don't have a mortgage.

Built in 1950-1970Lot of boomers with a lot of houses.

That's when mine was built. I'm alright with that. They built shit a lot heavier then.Built in 1950-1970

Better than some of those 1910-1930ish housesThat's when mine was built. I'm alright with that. They built shit a lot heavier then.

Thought about this today. One of my sets of grandparents own 4 houses. Only one is a rental. He was a firefighter amd she worked at the school. Work harder punk kids...Lot of boomers with a lot of houses.

Yep! My mom owns 4 houses also and stays at my house more than any of themThought about this today. One of my sets of grandparents own 4 houses. Only one is a rental. He was a firefighter amd she worked at the school. Work harder punk kids...In all seriousness the younger generation that is somehwat smart with there money is gonna get they're oppurtunity. Might not be a golden one but it's coming, people keeping that credit card debt at an all time high and rising is gonna catch up sooner or later. Could be wrong, but I hate when I'm right.