SAJ-99

Well-known member

Not to derail the thread, but the first thing I thought of is getting a spam call offering an extended warranty on a knee replacement.Parts and labor warranty?

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Not to derail the thread, but the first thing I thought of is getting a spam call offering an extended warranty on a knee replacement.Parts and labor warranty?

Very similar experience as my sister. Only they were able to ambulance them to the nearest children's hospital, but then stayed for 6 weeks. Where they live there's is only one option for health insurance, they had the gold plan. When they were do the hospital sent them a bill for 244k, said it was out of network and not an emergency, since they came from another hospital... they tried to negotiate but there's only payment option was 2 years. Try paying for a house in two years, on top of already paying for a house, and you weren't working for like 2 months. They threatened to take her house. It was incredible scary as our entire family came together to figure out a way to pay it (cough @mulecreek ) as family doesn't let family go broke.Insurance is a tough thing to navigate through, you're damned if you have it and you're damned if you don't. When my wife was pregnant she was just finishing up her teaching credential so I had insurance through the farm I was the mechanic for. I was paying $500 or so a month for just the two of us and the deductible was $4500 individual and $8000 max out of pocket. What we unfortunately came to find out was that out of network had no limit...

Our son had a rough time when he finally arrived and was immediately air lifted to the local children's hospital. He stayed in the NICU for 10 days. We were assured everything financially would be fine since we were "insured". We had put aside the $8,000 since we figured we would hit the max out of pocket with a normal unproblematic birth and we would be covered after that.

Apparently not only was the helicopter out of network but so was the children's hospital. The hospital bill was over $200k and the life flight was 50k. We are having the hospital review our case for hardship but that has been over a year now and we still don't have an answer for that. After going round and round between insurance and the life flight company, insurance paid for half and we got the life flight company to settle on us paying 10k instead of the remaining 25k. We have been paying non interest payments on that bill and will be for the next few years.

Be careful thinking "nothing can happy to me, I'm healthy" guys!

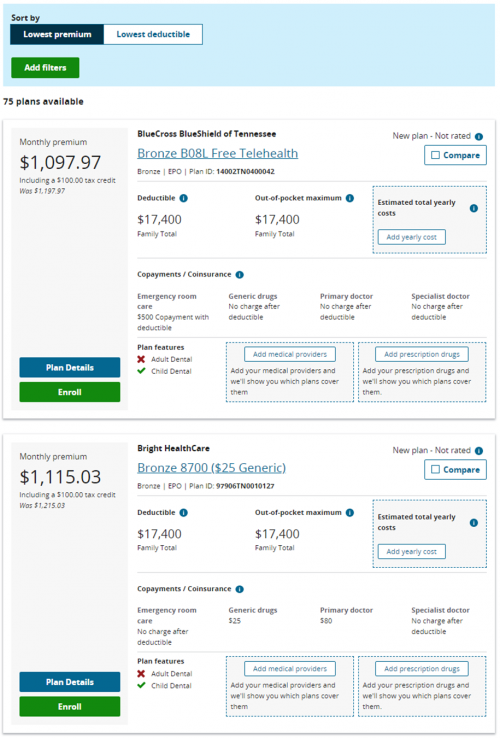

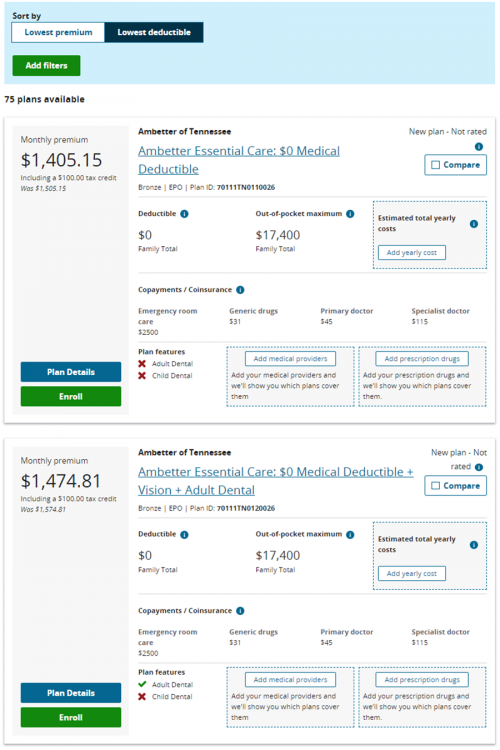

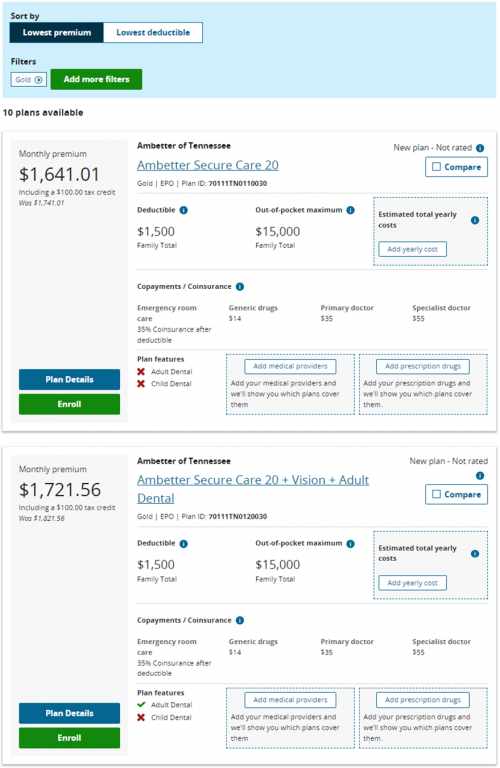

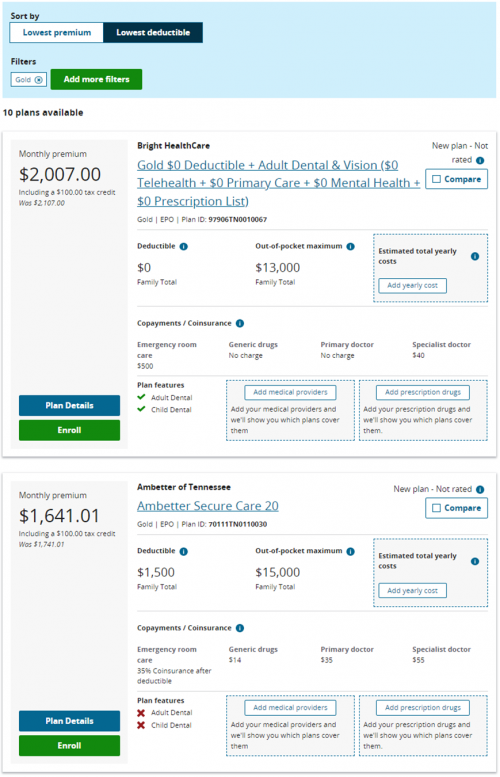

And a normal person is supposed to wade through all that shit? Really?Couple of things.

Guaranteed issue individual insurance which is highly subsidized by the government, it is also highly regulated ergo it is also high cost if you don't get the Advanced premium tax credit.

A lot of things could reduce the cost of both care and premiums however it requires either a waiver from the Federal Government (CMS) or to move outside the ACA guidelines and offer non guaranteed plans.

For everyone complaining about their insurance, I wonder how many have taken the time to sit down and read what is actually covered. Like the person who claims the insurance company changed the way colonoscopy's are covered. Willing to bet one was pre ACA and the other post ACA because the policy language was required by the law to change how such procedures were covered. Also your insurance company would have been required to send you a new updated policy containing all of that info and I am willing to bet the pages were never turned to review how things were covered.

This isn't a defense of the insurance companies either. They drive me nuts with the imagining denials, step therapy requirements, changing formularies, narrow networks, per incident charges in addition to your out of pocket max, pick an issue and I deal with daily.

It's insane on both sides of the ledger, from what the companies do to what people expect or don't bother to find out.

Nemont

People expect...what people expect

Couple of things here. Providers (Docs, PAs, NPs) have very, if any, control over the billing practices. If it’s a small independent outpatient clinic, maybe. But if it’s part of a hospital or hospital system, forget it. I can’t even get accurate cost estimates for my patients about how much their visit or a procedure will cost. Administrators and health insurance companies are the collective devil. If the cost for a procedure is $10, then the billed price will be $10k. An agreement will be made with the insurance company to accept $12, but if you’re self-pay it’s $10k. It’s absolutely robbery and it makes me nauseated to practice in such a system.

Gone are the days of the physicians with power, pocketing large sums of money and spending the day on the golf course. Those are hospital administrators now. Anyone actually practicing medicine is a replaceable drone.

There’s no kickbacks, no under the table deals, no secret plan to rob you. We are all just trying to make it through the day with a shred of our soul intact.

You realize policy language is required to be able to be read at a 4th grade level in most states?People expect...

1. that they are have the ability to purchase a plan to assist with healthcare costs

2. that by paying their premium they will receive some form of equitable value in their health costs

3. that it does not take a law degree to understand, implement, or derive, from #1 and 2.

Look I get it the system sucks, trust me I know. Tell me what the American public would accept as an alternative and I will be in your corner

www.pewresearch.org

www.pewresearch.org

A doctor has never talked cost with me. Do you bring it up to them before you leave or before they leave the room? I was once charged about 350 for a docor to walk into the room and ask if I had any questions after passing kidney stones to which the only question I had was, what's the best way to avoid kidney stones in the future. I definitely would have let the nurse know don't bother had I know it would cost me for him to walk into the room for 5 minutes.Has anyone ever had luck negotiating with docs? I’ve only done it several, but they usually knock off 20% immediately without any kind of fight, which is pretty telling.

The costs are beyond comprehension. I can tell you it’s about $5,000/day for labor and delivery before insurance adjustments. Just paid the invoice for our son born in September which depleted our HSA.

1. Sorry for being an immature fool Sunday morning.It is a mess. I spent a couple hours on the phone one day after my wife had an outpatient procedure done. We had a significant bill from the anesthesiologist, which should have been covered. The answer I got was the anesthesiologist was an out of network provider. I asked why the hell our network physician used an out of network anesthesiologist. I was told “that was who was available today”.

Massive anti trust efforts against health insurance providers.You realize policy language is required to be able to be read at a 4th grade level in most states?

Look I get it the system sucks, trust me I know. Tell me what the American public would accept as an alternative and I will be in your corner

Is there some type of supplemental health coverage that covers Tinder activity?1. Sorry for being an immature fool Sunday morning.

2. When I turned 26 and got booted off my moms plan I tried to do the right thing and get insurance.

If I remember correctly I picked up a policy on my bday on April 27th while I was living in the apartment in my dads rig shed.

In august of that year I bought a house and moved out.

Since it was my parents place and I frequently have to go there for work I never changed the address on my health insurance policy and just collected the bill from their mailbox and made the payments.

During the open enrollment for the following year starting in January I changed the address to my new home.

I received a bull for January at my new address.

The bill for February went to my parents house.

I did not receive a bill in March.

I received a bill in April for March and April and promptly paid it.

In may I went to the doctor and upon presenting them with my insurance card I was informed that my policy wasn’t active.

I thought that was weird, but I knew it wasn’t gonna cover the visit anyway so whatever.

Around the same time I received a refund for my March and April bill and a letter saying my policy was cancelled at my new address.

I assumed correcting this clerical error would be quick and painless but boy was I wrong.

I spoke with 3 different agents who told me my policy absolutely would not be reinstated due to me Aca guidelines and me missing a payment by more than 30 days.

Remember that bill for March I mentioned I never got?

Remember how they’re sending bills back and forth to my old address and new one?

After raising 10 kinds of hell on the phone I finally got ahold of someone who would listen and I had to take off work and go show them all the bills I’d saved that had been going back and forth between my old address and new one and finally he reinstated the policy.

He had a sign in his office that said:

-no foul language

-no violence

-no weapons

what a weird line of work to be in.

And for the record they never offered to refund January or February so they were gonna pocket that and I’d have to pay the old tax penalty.

After that I heard Dan Pena talking about healthcare on JREAnd decided since I really didn’t have anything to lose I was just gonna roll the dice and go uninsured

In the past 5 years of being uninsured the only time I’ve ever wished I had insurance or could go to the doctor is when I passed out after the covid vaccine that I probably didn’t need and suffered serious head and neck trauma.

But I just had to sign the release form and hobble out of the ambulance

Neck still hurts.

Trojans.Is there some type of supplemental health coverage that covers Tinder activity?

That’s what the $40 a month guy’s for.Is there some type of supplemental health coverage that covers Tinder activity?