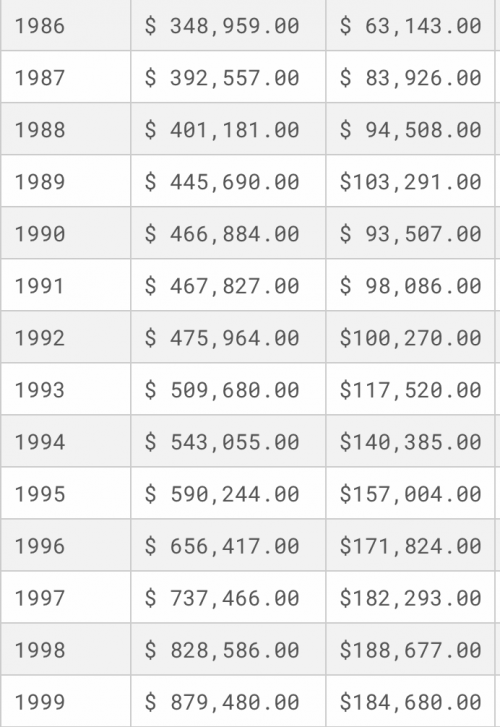

I agree and well said WLLM. IMO The lower corp rate boosted inflation pressure as businesses grew and spent pretax cash/income on capital expenses land improvements etc. Increasing demand on just about everything by putting that cash into our economy>> AND OUT OF THE GOVERNMENTS hands directly.There is, I think we can all agree, a growth rate that is sustainable for the economy. Too much or too little and you have issues, agree?

There are various mechanism via which a country can make adjustments to keep an economy in a healthy position.

Make hay while the sun shines, and then store it for the lean times?

Perhaps @SAJ-99 agrees with this perhaps not... but my opinion.

Conservation = Wise Use

I think of myself as having a conservative economic outlook. Therefore my outlook is that the tax code should be used as a tool. We have seen ridiculous inflation rates recently, yes?

Therefore I think we/the fed should have done things like raise the corporate rate, individual rate as well as the interest rate in order to rein in the hot economy and to consolidate gains, ie pay of your debts when you're making money, don't increase your spending.

In household economics we might call this lifestyle creep.

Neither party balances the budget or is fiscally responsible, but IMHO republicans saying they are fiscally conservative and then never raising taxes is ridiculous... as is raising taxes just to immediately spend 2x that amount, which is the Democrats MO.

See the folks who want higher income and business taxes believe in BIG GOVERMENT. They think the government should spend the money and not the business owner or the W2 worker. They typically work for the government or make a living as a politician or have businesses that are government contractors or government dependent. It's just that simple.

Those on the left love just love the word corporation. Thats why we heard it here today in every other sentence from them. Its a bad dirty word right. Seriously what percentage of c corps have revenues over 10million bucks?? Or should I say what percentage of corporations including s corps have revenues over 10 million?? I am guessing 95% do not.

The said 95% are the mom and pop businesses or the local companies that drive small town america. When they sit down and do their forecasting they think of the cash available at the year end and what they are gonna spend on capital expenses> trucks/improvements/Bonuses/raises/donations to the community etc/eqpt/tooling/remodeling/. When they know their tax rate/bill will be lower there is more cash available to invest in their business and the local economy. Then other local businesses have good business growth and also do the same cycle.

Oh the dirty word dividend > the c's> Yes they might even have enough cash to pay those who invested in them a few bucks in a dividend which is DOUBLE TAXED at 15% on the shareholders personal taxes and then taxed by the state.

Small and rural america is benefitting from lower corp tax rates.