SAJ-99

Well-known member

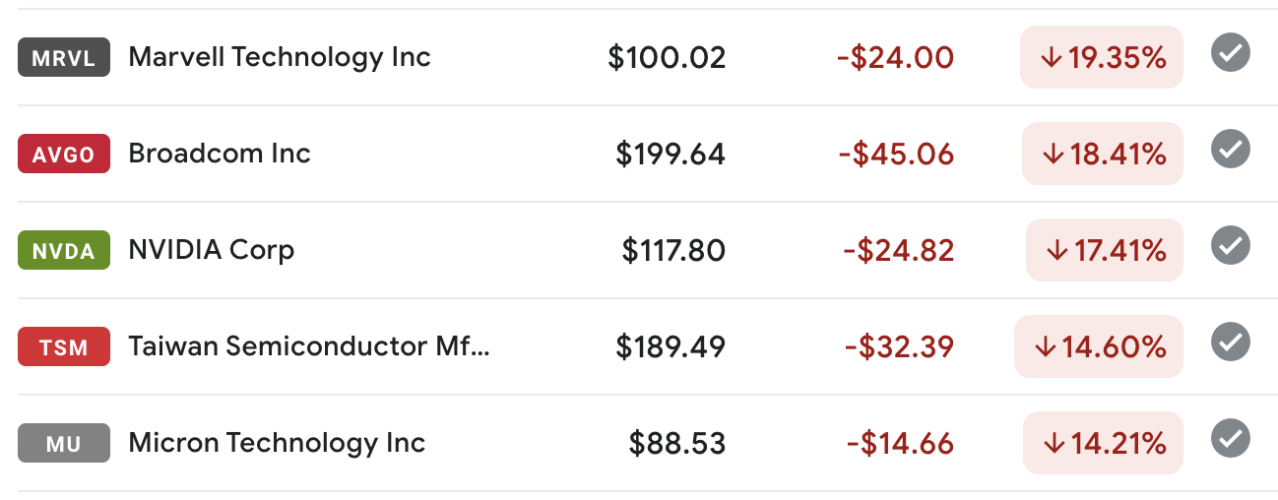

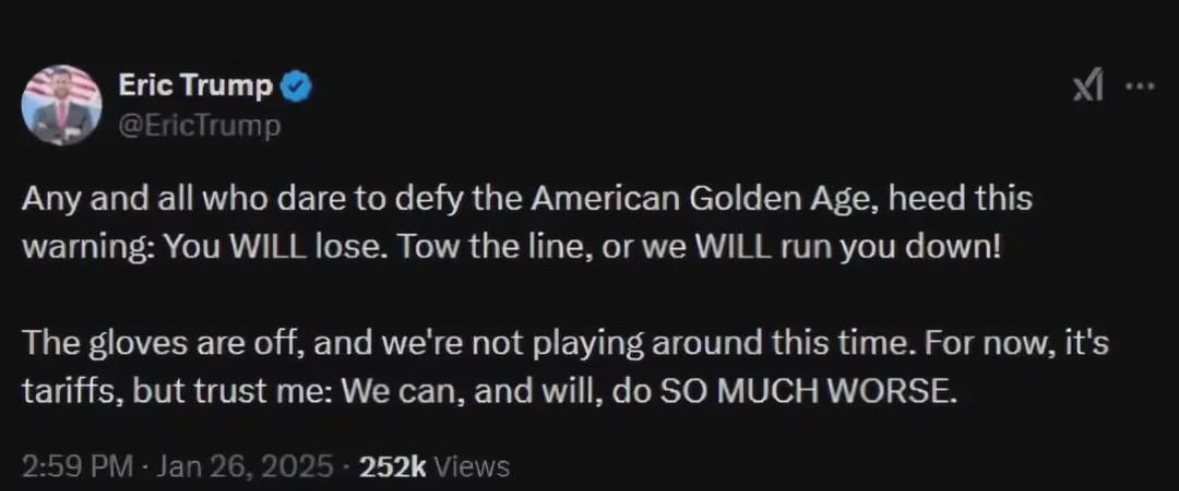

Probably not. They all do the same thing. The fees are collected from selling the order flow and you won't be able to parse the data in any meaningful way to determine execution quality. You won't know if you made the right choice until something blows up. Like when GME was halted and Robinhood told customers they couldn't buy any, only sell. Sometimes that decision is driven by the clearing broker and not the owner of the app you are using. Only thing that I wonder about is Webull is paying over 4% on cash. Seems too good to be true, but I can never get good information on the nuts and bolts of these retail-focused brokers. There is a lot that goes on behind the scenes that can go wrong.My question is, is there an app that strongly stands out among the rest?

Full disclosure, I don't ever buy fractional shares.