AlaskaHunter

Well-known member

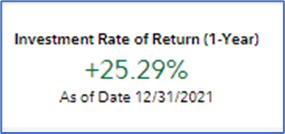

Well with the year end, the S&P 500 rose by 27% in 2021....

the Dow gained 19% , while the Nasdaq gained 21%.

The Fed kept interest rates near zero and continued pumping billions of dollars into markets each month in 2021.

And Congress pass COVID-relief packages and huge infrastructure bills.

2022 will be likely different with a rise in interest rates, the Fed ending their monthly bond-buying program by March 2022,

the House/Senate likely to flip and no more big spending bills out of Congress, plus likely substantial inflation in 2022.

the Dow gained 19% , while the Nasdaq gained 21%.

The Fed kept interest rates near zero and continued pumping billions of dollars into markets each month in 2021.

And Congress pass COVID-relief packages and huge infrastructure bills.

2022 will be likely different with a rise in interest rates, the Fed ending their monthly bond-buying program by March 2022,

the House/Senate likely to flip and no more big spending bills out of Congress, plus likely substantial inflation in 2022.