grizzly_

Well-known member

- Joined

- Feb 18, 2013

- Messages

- 1,242

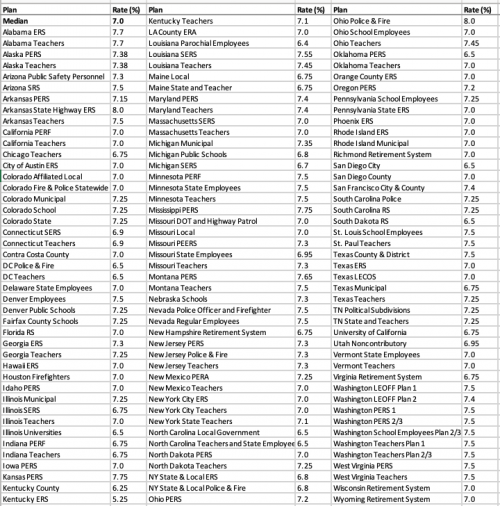

What percentage does everybody use when projecting growth on a retirement calculator?

Ramsey has 12% on his online calculator as the historical 30-yr average for the S&P, but I don't believe that's annualized. It also doesn't account for inflation.

I've been using 6.7% to figure for annualized returns and inflationary loss... because I want to know how much money I'll have in numbers I can understand and apply to my quality of life. I don't care that my parents bought their first home for $43,000, a new F-350 is nearly twice that much now. I need my retirement to be in dollars I can use, not dollars that are worth pennies when I need them.

Am I crazy to use 6.7%? If so, too conservative or not conservative enough?

___________

For example, a 35 year old starting today and putting away $500/month at 6.7% would have $670,098 at age 67, according to Ramsey.

The same person using 12% returns would see $2,232,323 on Ramsey's calculator.

Obviously a massive difference in quality of retirement.

So which number is more correct?

Ramsey has 12% on his online calculator as the historical 30-yr average for the S&P, but I don't believe that's annualized. It also doesn't account for inflation.

I've been using 6.7% to figure for annualized returns and inflationary loss... because I want to know how much money I'll have in numbers I can understand and apply to my quality of life. I don't care that my parents bought their first home for $43,000, a new F-350 is nearly twice that much now. I need my retirement to be in dollars I can use, not dollars that are worth pennies when I need them.

Am I crazy to use 6.7%? If so, too conservative or not conservative enough?

___________

For example, a 35 year old starting today and putting away $500/month at 6.7% would have $670,098 at age 67, according to Ramsey.

The same person using 12% returns would see $2,232,323 on Ramsey's calculator.

Obviously a massive difference in quality of retirement.

So which number is more correct?