SAJ-99

Well-known member

https://apnews.com/57de322833f2843ac53d17e043be35a0

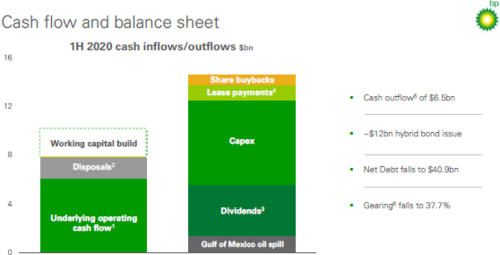

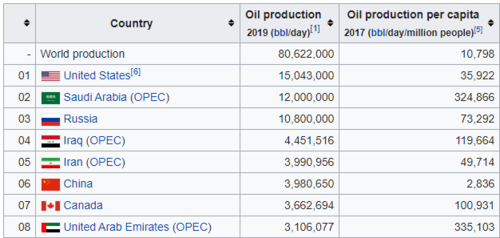

So despite oil prices at $42 and OG exploration companies saying they are even pulling back on looking for new deposits this lease-sale is going forward. Not a fan of drilling for oil on ANWR in general, but as an American citizen I feel like selling the lease in this environment is a bad idea.

So despite oil prices at $42 and OG exploration companies saying they are even pulling back on looking for new deposits this lease-sale is going forward. Not a fan of drilling for oil on ANWR in general, but as an American citizen I feel like selling the lease in this environment is a bad idea.