Zim

Well-known member

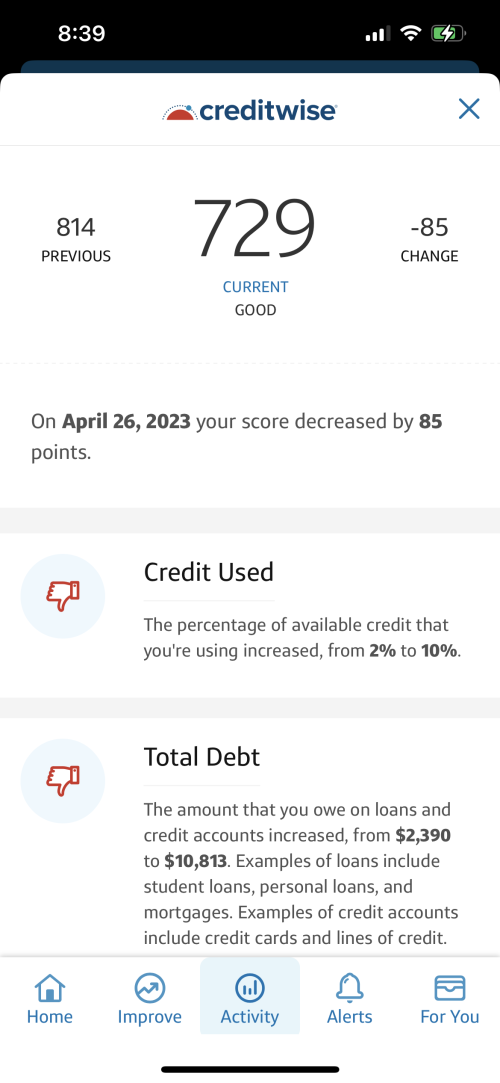

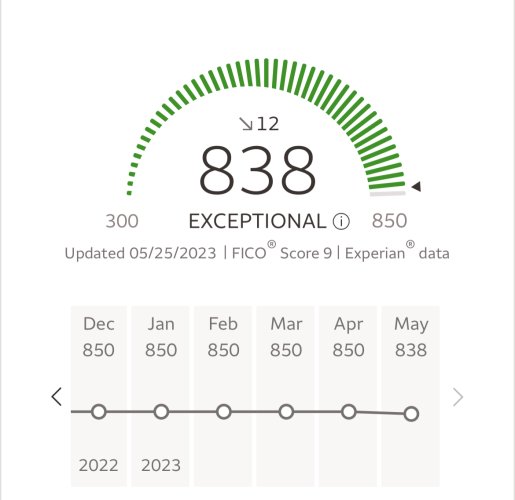

Anyone else had their credit FICO score fall this much just from hunting application up front fees? Went all in on New Mexico this year and got this surprise package on my Capital One CC  . I don’t take these FICO alerts from CC’s much seriously because I know my actual credit score can’t possibly fluctuate this much. Real credit score not much concern for me as my house, cars, bills, etc. are all paid. I’m old and don’t do loans

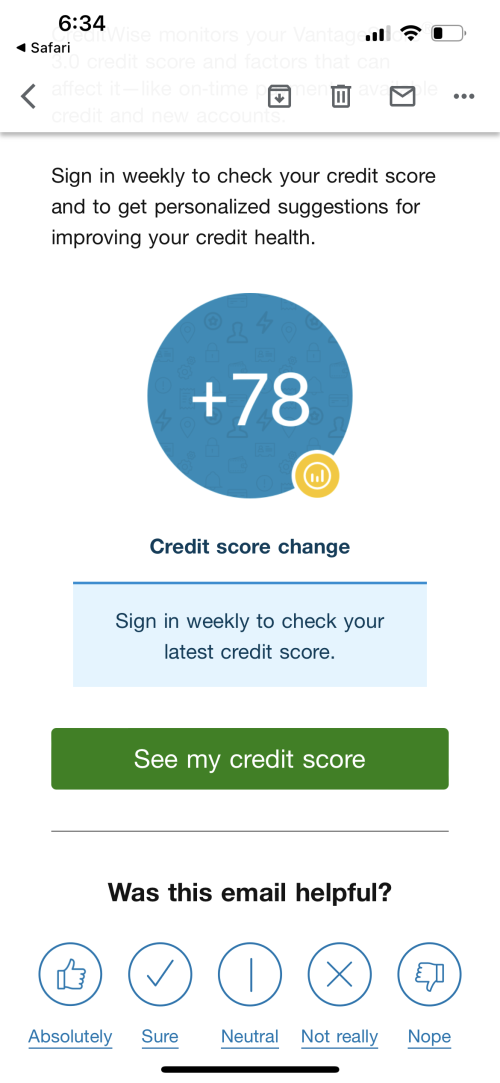

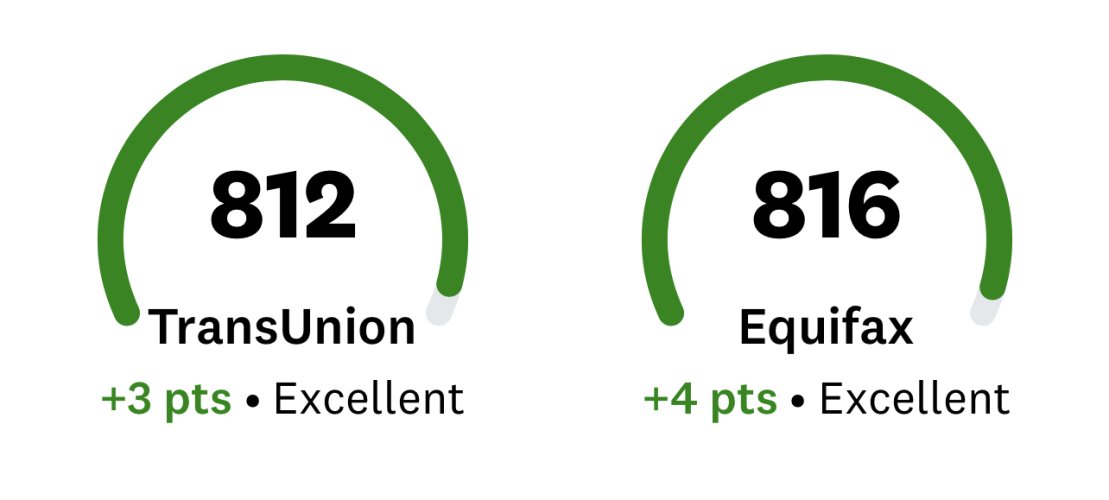

. I don’t take these FICO alerts from CC’s much seriously because I know my actual credit score can’t possibly fluctuate this much. Real credit score not much concern for me as my house, cars, bills, etc. are all paid. I’m old and don’t do loans  . But I don’t get why score fluctuates so much.

. But I don’t get why score fluctuates so much.