Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anybody Buying Yet? Where’s the Bottom?

- Thread starter NEWHunter

- Start date

Nickman123

Member

- Joined

- Jan 5, 2022

- Messages

- 40

I tried hard to get her to rent condo but she wasn't having it. She couldn't stand the thought of being landlord to someone else living in "her" place. Also, in California you can get screwed hard as a landlord if you get a bad renter. All the tenant protection laws can let someone who knows how to play the game live in your place 6 mos to a year without paying before you can finally evict them.He's not lying, but it's not that simple. Bond funds buying today, will see bonds lose value if they raise the rates. Last I looked such was expected. Buying bonds and CDs directly and holding to term will generate income without loss to speculative buyers and sellers, but then there's taxes.

Beating inflation and taxes while generating real income means luck with stocks or rental real estate. Why didn't she just rent the condo out?

Where I live, she could pick up a rental property for $100k and have it pay for.itself while appreciating. Let a service.manage it for her. I know a rral estate agent who would work on that with you. Bank the rest in short term CDs and tbills.

Just an idea. For all I know there may be tax laws where you are that make all that a terrible idea. Also I can't imagine buying real estate without traveling to do it in person. People are though.

Just an idea. For all I know there may be tax laws where you are that make all that a terrible idea. Also I can't imagine buying real estate without traveling to do it in person. People are though.

SAJ-99

Well-known member

6% seems a little high for investment grade bond fund unless it is short term paper, but 5%+ is reasonable on the liner end. But I would be worried about the “totally liquid” quote. Sure it’s liquid but it doesn’t mean it won’t lose money. Not going to address the “hold the bond to maturity and you never lose value” argument. It’s both true and mathematically not that simple.My mother sold her condo and moved into assisted living. She has a good pension which pretty well covers the monthly cost of the assisted living place. She netted about 550k from the condo. What does she do with it? I was going to just have her put it in CD's which are running about 5%. The financial guy who does our 401k's recommends she put it in a "bond fund". Says it should make about 6% while remaining totally liquid. Got any better suggestions?

Short answer is a high grade bond fund is fine but check what it invests in. It might not earn 6% very long if the Fed starts cutting rates next year.

SAJ-99

Well-known member

I don't see any reason for a steeper selloff. Stocks were expensive and at the top of the channel. Now they lose 5% and are at the bottom of the channel. Pretty normal price action and mostly looking driven by algos. The market finally taking the Fed's "higher for longer" quote seriously. I think we still need to see weakness in the job market before I reset my expectations. S&P 2023 earnings still on pace for a record at around $223/sh. 2024 numbers look a little high at near $250, but forward earnings are always a little optimistic this time of year.things are getting more interesting no?

what's gonna break the camels back?

trackerbacker

Well-known member

- Joined

- Jun 30, 2023

- Messages

- 464

I thought I saw they were going to keep rates high until 2028? I'll dig it up, but it was just a glimpse in passing deal6% seems a little high for investment grade bond fund unless it is short term paper, but 5%+ is reasonable on the liner end. But I would be worried about the “totally liquid” quote. Sure it’s liquid but it doesn’t mean it won’t lose money. Not going to address the “hold the bond to maturity and you never lose value” argument. It’s both true and mathematically not that simple.

Short answer is a high grade bond fund is fine but check what it invests in. It might not earn 6% very long if the Fed starts cutting rates next year.

Eta

Interest rates staying 'higher for longer' means at least through 2026 for the Fed

The Fed kept rates steady on Wednesday but suggested a less friendly outlook for investors betting on the central bank starting to back off its efforts to bring inflation down.

That wasn't the article, but an article about it

Last edited:

SAJ-99

Well-known member

Any forecast longer than 6 months shouldn't be given much value. I don't think they know what they are going to do or when. The Fed dot plot shows they all expect to move to 2.5% by 2026ish. I can say that is probably incorrect, but can't say what direction. I would argue that a 4.5% 10yr isn't high by historical standards and probably reasonable. The economy can adjust to that eventually. It just doesn't like how fast it got there.I thought I saw they were going to keep rates high until 2028? I'll dig it up, but it was just a glimpse in passing deal

trackerbacker

Well-known member

- Joined

- Jun 30, 2023

- Messages

- 464

50 or 60 year average for consumers mortgage has been 7.5 or 7.7%, something like that. So I don't personally see the panic between a 3-5% hold.Any forecast longer than 6 months shouldn't be given much value. I don't think they know what they are going to do or when. The Fed dot plot shows they all expect to move to 2.5% by 2026ish. I can say that is probably incorrect, but can't say what direction. I would argue that a 4.5% 10yr isn't high by historical standards and probably reasonable. The economy can adjust to that eventually. It just doesn't like how fast it got there.

Hard to say any direction given elections etc and appointments.

Though their current torn mean cpi × median something or other doesn't correlate well to current felt inflation, so it's truly a wizards hat regarding what they'll do and say.

The death by a thousand cuts early on should've just been 1 large or 2 bigger jumps then hold and drip as needed.

Regulatory costs are going to hurt more than rates to a point.

SAJ-99

Well-known member

Quick update. S&P 500 holding 200day MA, but 10yr yield over 4.75%. Quite the battle going on between markets. Energy finally catching up to reality and feeling some pain with everything else. Anything that has a dividend and considered a bond proxy, like REITs, utilities, consumer staples, telecom, and big energy, are following the 10yr bond.

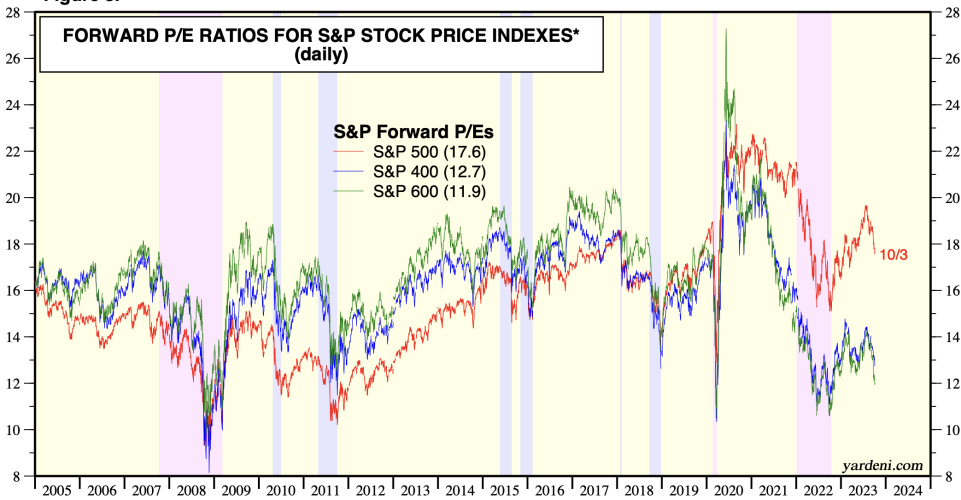

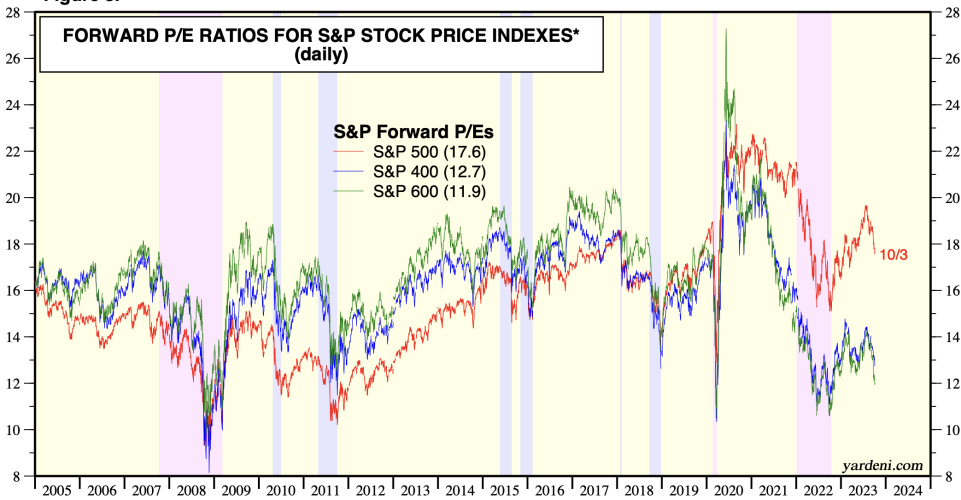

This picture is a good snap shot of what is going on. The favorite measure of valuations (P/E) from Yardeni research. The Mid and small caps are very cheap compared to recent history and there is still a large gap between large and the rest, which shows how people paid up for the top 10 names.

I plan to start to nibble and add to some equity exposure at these levels.

This picture is a good snap shot of what is going on. The favorite measure of valuations (P/E) from Yardeni research. The Mid and small caps are very cheap compared to recent history and there is still a large gap between large and the rest, which shows how people paid up for the top 10 names.

I plan to start to nibble and add to some equity exposure at these levels.

Flatlander3

Active member

Anyone have opinions on VIR?

SD_Prairie_Goat

Well-known member

I've been jumping in on small caps pretty hard using the same logic that they are discounted. Any thoughts on how long it'll take to bring them more in line with historic levels? Will they go up, and if so what would be the main driver of that?Quick update. S&P 500 holding 200day MA, but 10yr yield over 4.75%. Quite the battle going on between markets. Energy finally catching up to reality and feeling some pain with everything else. Anything that has a dividend and considered a bond proxy, like REITs, utilities, consumer staples, telecom, and big energy, are following the 10yr bond.

This picture is a good snap shot of what is going on. The favorite measure of valuations (P/E) from Yardeni research. The Mid and small caps are very cheap compared to recent history and there is still a large gap between large and the rest, which shows how people paid up for the top 10 names.

I plan to start to nibble and add to some equity exposure at these levels.

View attachment 295250

SAJ-99

Well-known member

Honestly, your guess is as good as mine. I have put more in mid caps. The small caps typically have a lot of debt and too high a % don’t make money. I have some S&P 600, which are high quality small caps. It is certainly possible that we could be waiting a while for this situation to revert back to “normal”. Intl and EM have been cheap relative to US for 15 yrs.I've been jumping in on small caps pretty hard using the same logic that they are discounted. Any thoughts on how long it'll take to bring them more in line with historic levels? Will they go up, and if so what would be the main driver of that?

GDP 4.9% rise. Good read.

seekingalpha.com

seekingalpha.com

GDP Surprise Throws Predictions Out The Window

US Third Quarter GDP grew at 4.9%, driven by Personal Consumption Expenditures. Concerns arise over consumer debt levels and rising delinquencies. Read more here.

Summary

- U.S. Third Quarter GDP grew at 4.9%, the highest rate in two years, led by Personal Consumption Expenditures - PCE.

- Inventory buildups contributed to growth, while Net Exports reduced GDP.

- Concerns arise over high consumer debt levels and rising delinquencies, as interest rates are expected to rise.

- Fiscal and monetary policy are working at cross-purposes so that the Federal Reserve can continue to pause as the market does the Fed's job.

- We expect consumer discretionary stocks, regional banks, and bonds to all decline. We're in anomalous times

trackerbacker

Well-known member

- Joined

- Jun 30, 2023

- Messages

- 464

4.9% gdp....led by...GDP 4.9% rise. Good read.

GDP Surprise Throws Predictions Out The Window

US Third Quarter GDP grew at 4.9%, driven by Personal Consumption Expenditures. Concerns arise over consumer debt levels and rising delinquencies. Read more here.seekingalpha.com

Summary

- U.S. Third Quarter GDP grew at 4.9%, the highest rate in two years, led by Personal Consumption Expenditures - PCE.

- Inventory buildups contributed to growth, while Net Exports reduced GDP.

- Concerns arise over high consumer debt levels and rising delinquencies, as interest rates are expected to rise.

- Fiscal and monetary policy are working at cross-purposes so that the Federal Reserve can continue to pause as the market does the Fed's job.

- We expect consumer discretionary stocks, regional banks, and bonds to all decline. We're in anomalous times

Personal expenditures and historic inflation

Gov expenditures and historic government spending.

That's like saying inflation is only 2% when you take everything that's inflated out. "People are spending more, we, the government are spending more, look, bidenomics at work, gdp on the rise!"

Consumer debt levels, escalating interest rate, 5 year bonds, credit tightening, regional banks bond portfolios and unrealized losses coming to the books, and they can't predict the next few months of economic outlook yet we know for certain climate change will kill us all if we don't buy electric vehicles by 2027.

As an investor, I hope all the above becomes worse. There will be good (or better the more protracted it becomes) deals, nice toys and sweet views coming to market looking to be capitalized on.

I'll be moving some liquidity around between q4 and end of q1, but the land assets will sit for now, maybe action in q2 or late q1. Personally hoping Joe wins term 2 and we run deeper, inflation continues, credit tightens way more, college enrollment declines. I'll be ready then.

Benfromalbuquerque

Well-known member

- Joined

- Jul 15, 2020

- Messages

- 1,621

He was six years older than Bert and we’ll see now how BRK operates without a deputy chief.RIp Charlie Munger.

SAJ-99

Well-known member

Neither are/were making the investment decisions anymore. Buffett and Munger had a transition plan in place for over two decades and took a long time in selecting successors.He was six years older than Bert and we’ll see now how BRK operates without a deputy chief.

grizzly_

Well-known member

- Joined

- Feb 18, 2013

- Messages

- 1,242

It'll be interesting to see how BRK responds tomorrowNeither are/were making the investment decisions anymore. Buffett and Munger had a transition plan in place for over two decades and took a long time in selecting successors.

A favorite live video conference to watch for quarterly earnings reports. The duo always flashing their Diet Cokes.

Great minds.

RIP, Charlie Munger. 99. y/o. January 1st, 1924.

"We all are learning, modifying, or destroying ideas all the time. Rapid destruction of your ideas when the time is right is one of the most valuable qualities you can acquire. You must force yourself to consider arguments on the other side."

Great minds.

RIP, Charlie Munger. 99. y/o. January 1st, 1924.

"We all are learning, modifying, or destroying ideas all the time. Rapid destruction of your ideas when the time is right is one of the most valuable qualities you can acquire. You must force yourself to consider arguments on the other side."

Similar threads

- Replies

- 18

- Views

- 1K

- Replies

- 1

- Views

- 212