I trade equities for a living now(retired once) when i am not hunting or fishing. If there are any serious traders who might be interested in bouncing ideas back and forth let me know. I focus on specfic commodities, US stocks and indexed etfs mostly on a swing trade time frame.

Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Any full time investors?

- Thread starter ccc23454

- Start date

NEWHunter

Well-known member

Trading is over my head. I’m a buy and hold guy with ETFs for the most part. Will be interesting to hear how many folks around here are in to that type of thing.

Brittany Chukarman

Well-known member

What do you think about the UGI/APU merger for an APU dividend player?

Chippewa

Member

- Joined

- May 5, 2019

- Messages

- 96

5G, AI, quantum computing, and technology that will use them or make them happen. Auto industry make shake up with self driving pods an super highways.

Check out Glen Beck Joe Brown interview on youtude. It was at least entertaining. I studied at PennState nanofab for a bit an alot of the buzz was about future computing changing the world. So the time is near I guess...

Check out Glen Beck Joe Brown interview on youtude. It was at least entertaining. I studied at PennState nanofab for a bit an alot of the buzz was about future computing changing the world. So the time is near I guess...

SD_Prairie_Goat

Well-known member

I'm a simpleton, buy ETF's and hold them as my "emergency fund".

Only thing I ventured away from ETF's was to buy some stock in Alibaba for fun. I tell you what, buying individual stock sure can be a rollercoaster ride!

I've always thought about trading more, but I don't understand the markets well enough to really try my luck at them.

I'm sure someone around here must tho

Only thing I ventured away from ETF's was to buy some stock in Alibaba for fun. I tell you what, buying individual stock sure can be a rollercoaster ride!

I've always thought about trading more, but I don't understand the markets well enough to really try my luck at them.

I'm sure someone around here must tho

Day/swing trade. Mainly focused on pre/aft earnings however sometimes the PGC type $ day/swing trades are too hard to pass up. Call & Put - Longs & Shorts.

ETF's on occasion though mainly stock & option trading.

It's not my full time "gig" though it's a daily activity.

ETF's on occasion though mainly stock & option trading.

It's not my full time "gig" though it's a daily activity.

SAJ-99

Well-known member

sbhooper

Well-known member

I may be interested in the investment in Black Velvet, or Lord Calvert etc., but anything else will do me little good at my age. I am drawing "from" and not investing"in".

LopeHunter

Well-known member

I am for the most part a 3-fund guy that buys, holds and reinvests equites and bonds. I have about 10% in individual stocks, though, and again those equites are buy and hold. I began holding bonds (BND) as a part of my portfolio only in last 3 to 5 years. Before that was 100% equities (mostly VTI) but am now knocking on age 60's door so holding some bonds along with real estate seems prudent.

All the research I encountered as an undergrad in the 1980s and grad school in the 1990s backed up the rule of thumb you can beat the return on the whole stock market but you can't do so year after year after year unless have insider info or are the exception that proves the rule. Think of actively trading as Vegas. If 1000 of us go to Vegas with $100,000 to play slots then only a small number, likely under 50, will have doubled our money and several of us will be in negative territory. More than likely several of the ones that doubled their money hit a jackpot early on and stopped at that point rather than churn the money back through the system a few times. Just look at fund managers and compare their most recent year vs VTI. More that half fall short. Of those that out-performed VTI then if they have a 5-year return then compare to VTI, net of fees of course. Most will not have 5 years of history as the manager though because the losers get canned or the investment company will shut down the fund and open a nearly identical one so the slate is clean rather than show came up short the past several years. These are the games played to get you to seek out actively-managed funds rather than go with low-fee VTI, BND, etc passive funds.

I hope you have a system that does very well for you. I play the odds and passive investing in a small number of big-bucket funds with very, very low annual fees and almost no commissions or short-term tax consequences has enabled me to double my money about every 8 years, multiple times. Getting an early start on saving is a factor that is often underappreciated.

Playing the market or chasing bitcoin and oil futures, etc, often relies on a look in the rear view mirror to craft the next investment trade but that is a risky strategy as the markets move not just on supply and demand but also by human psychological knee-jerk reactions and actual manipulation by major players which never can be fully built into a trading scheme.

I have a buddy that flipped houses about 20 years ago and in comparison I looked like the tortoise with my 5% and 8% returns during years he was doubling his money or better. He rolled over his gains in equity after each successful flip to buy bigger homes to flip and more homes to flip. He was swinging for the fences while I was tapping out bunts. His wife loved him. His mother-in-law loved him and handed him the bulk of her savings. The housing market crapped out and he went bankrupt while having 7 homes on the ocean in SoCal. He owned none of those and putting renters in the units he could not sell as were under water would not cover the cash flow needed to stay afloat. Oh, the mother-in-law and wife no longer loved him.

This same buddy told me he is now trading bitcoin and similar items these days. He is making a killing per him. I am an idiot per him. He may be correct re me being an idiot. I know I sleep very, very well and owe not one cent to anyone on my two homes and am very happy with my investment account balances. I have the same wife I had decades ago. I am told stress kills. I have less stress than my buddy now and for the past few decades. I like being the idiot.

All the research I encountered as an undergrad in the 1980s and grad school in the 1990s backed up the rule of thumb you can beat the return on the whole stock market but you can't do so year after year after year unless have insider info or are the exception that proves the rule. Think of actively trading as Vegas. If 1000 of us go to Vegas with $100,000 to play slots then only a small number, likely under 50, will have doubled our money and several of us will be in negative territory. More than likely several of the ones that doubled their money hit a jackpot early on and stopped at that point rather than churn the money back through the system a few times. Just look at fund managers and compare their most recent year vs VTI. More that half fall short. Of those that out-performed VTI then if they have a 5-year return then compare to VTI, net of fees of course. Most will not have 5 years of history as the manager though because the losers get canned or the investment company will shut down the fund and open a nearly identical one so the slate is clean rather than show came up short the past several years. These are the games played to get you to seek out actively-managed funds rather than go with low-fee VTI, BND, etc passive funds.

I hope you have a system that does very well for you. I play the odds and passive investing in a small number of big-bucket funds with very, very low annual fees and almost no commissions or short-term tax consequences has enabled me to double my money about every 8 years, multiple times. Getting an early start on saving is a factor that is often underappreciated.

Playing the market or chasing bitcoin and oil futures, etc, often relies on a look in the rear view mirror to craft the next investment trade but that is a risky strategy as the markets move not just on supply and demand but also by human psychological knee-jerk reactions and actual manipulation by major players which never can be fully built into a trading scheme.

I have a buddy that flipped houses about 20 years ago and in comparison I looked like the tortoise with my 5% and 8% returns during years he was doubling his money or better. He rolled over his gains in equity after each successful flip to buy bigger homes to flip and more homes to flip. He was swinging for the fences while I was tapping out bunts. His wife loved him. His mother-in-law loved him and handed him the bulk of her savings. The housing market crapped out and he went bankrupt while having 7 homes on the ocean in SoCal. He owned none of those and putting renters in the units he could not sell as were under water would not cover the cash flow needed to stay afloat. Oh, the mother-in-law and wife no longer loved him.

This same buddy told me he is now trading bitcoin and similar items these days. He is making a killing per him. I am an idiot per him. He may be correct re me being an idiot. I know I sleep very, very well and owe not one cent to anyone on my two homes and am very happy with my investment account balances. I have the same wife I had decades ago. I am told stress kills. I have less stress than my buddy now and for the past few decades. I like being the idiot.

Played $GME today that holds high earnings volatility - Put $8 for Jan 20. In @ 1.87

I played through this evening's earnings release. Depending on how it pans out come open tomorrow, it should be a decent return. Only 10 options though Like I said, not a full time gig, simply daily activity. Was going to run with a Strangle though all I viewed suggested a high probability it was going to tank.

Would love to work w/ 25k to clear the 3 turnarounds though this is hobby and not designed for a divorce.

I played through this evening's earnings release. Depending on how it pans out come open tomorrow, it should be a decent return. Only 10 options though Like I said, not a full time gig, simply daily activity. Was going to run with a Strangle though all I viewed suggested a high probability it was going to tank.

Would love to work w/ 25k to clear the 3 turnarounds though this is hobby and not designed for a divorce.

RemingtonRules

Active member

- Joined

- Aug 11, 2016

- Messages

- 151

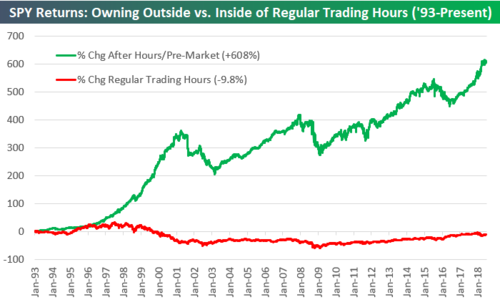

This chart is a little dated, but the premise still holds and is a great for starting a debate as to why this is the case.

View attachment 122402

What is to debate? After hours is a thinly traded market. Significant volume in after hours usually follows some significant news that triggers trading buy or sell side focused on a few equities. Normal trading hours has the most volume and therefore less volatility across the entire market.

SAJ-99

Well-known member

The chart doesn't show volatility, per se. It shows when gains have been made. So ALL (in fact, more than all) of the gains in the SPX over the last 25 years have been made between the closing price and the next day's opening price. So day trading, buying early and selling before close, is shown to be incredibly difficult. If you had don't the opposite and just bought at the close and sold at the open, you would have received all the benefit of being in stocks. Liquidity is a non factor in this chart.What is to debate? After hours is a thinly traded market. Significant volume in after hours usually follows some significant news that triggers trading buy or sell side focused on a few equities. Normal trading hours has the most volume and therefore less volatility across the entire market.

rjthehunter

Well-known member

I tried that for a few months once. It was more of a give it a try than actually trying to safely invest a couple hundred bucks. After doubling my money, I was feeling confident with my choices at that point. Then I lost 2/3rds of it and decided I didn't have enough time to keep track of what the market was doing and follow the penny stocks I was messing around with.Day/swing trade. Mainly focused on pre/aft earnings however sometimes the PGC type $ day/swing trades are too hard to pass up. Call & Put - Longs & Shorts.

ETF's on occasion though mainly stock & option trading.

It's not my full time "gig" though it's a daily activity.

westbranch

Well-known member

Do any of the investors/traders want to share their annual returns over long term periods? Not just some one time wins? I know a guy that is a bond trader for a large investment bank. Makes obscene amounts of salary/bonuses for his job. His personal trading/investment account average returns were quite a bit below index fund averages. When I saw that he wasn't able to make a decent return it made me think what a waste of time/effort for me to try.

I like to keep the majority of our funds in VTSAX. I'll call myself a full time investor for purposes of this thread . https://investor.vanguard.com/mutual-funds/profile/VTSAX

. https://investor.vanguard.com/mutual-funds/profile/VTSAX

10 yr annual return 13%. 6.78% since 2000.

I like to keep the majority of our funds in VTSAX. I'll call myself a full time investor for purposes of this thread

10 yr annual return 13%. 6.78% since 2000.

OverlordBear

Well-known member

I am for the most part a 3-fund guy that buys, holds and reinvests equites and bonds. I have about 10% in individual stocks, though, and again those equites are buy and hold. I began holding bonds (BND) as a part of my portfolio only in last 3 to 5 years. Before that was 100% equities (mostly VTI) but am now knocking on age 60's door so holding some bonds along with real estate seems prudent.

All the research I encountered as an undergrad in the 1980s and grad school in the 1990s backed up the rule of thumb you can beat the return on the whole stock market but you can't do so year after year after year unless have insider info or are the exception that proves the rule. Think of actively trading as Vegas. If 1000 of us go to Vegas with $100,000 to play slots then only a small number, likely under 50, will have doubled our money and several of us will be in negative territory. More than likely several of the ones that doubled their money hit a jackpot early on and stopped at that point rather than churn the money back through the system a few times. Just look at fund managers and compare their most recent year vs VTI. More that half fall short. Of those that out-performed VTI then if they have a 5-year return then compare to VTI, net of fees of course. Most will not have 5 years of history as the manager though because the losers get canned or the investment company will shut down the fund and open a nearly identical one so the slate is clean rather than show came up short the past several years. These are the games played to get you to seek out actively-managed funds rather than go with low-fee VTI, BND, etc passive funds.

I hope you have a system that does very well for you. I play the odds and passive investing in a small number of big-bucket funds with very, very low annual fees and almost no commissions or short-term tax consequences has enabled me to double my money about every 8 years, multiple times. Getting an early start on saving is a factor that is often underappreciated.

Playing the market or chasing bitcoin and oil futures, etc, often relies on a look in the rear view mirror to craft the next investment trade but that is a risky strategy as the markets move not just on supply and demand but also by human psychological knee-jerk reactions and actual manipulation by major players which never can be fully built into a trading scheme.

I have a buddy that flipped houses about 20 years ago and in comparison I looked like the tortoise with my 5% and 8% returns during years he was doubling his money or better. He rolled over his gains in equity after each successful flip to buy bigger homes to flip and more homes to flip. He was swinging for the fences while I was tapping out bunts. His wife loved him. His mother-in-law loved him and handed him the bulk of her savings. The housing market crapped out and he went bankrupt while having 7 homes on the ocean in SoCal. He owned none of those and putting renters in the units he could not sell as were under water would not cover the cash flow needed to stay afloat. Oh, the mother-in-law and wife no longer loved him.

This same buddy told me he is now trading bitcoin and similar items these days. He is making a killing per him. I am an idiot per him. He may be correct re me being an idiot. I know I sleep very, very well and owe not one cent to anyone on my two homes and am very happy with my investment account balances. I have the same wife I had decades ago. I am told stress kills. I have less stress than my buddy now and for the past few decades. I like being the idiot.

Damn sound advice, I have been on a similar trajectory for the past 15 years. Slowly and steady wins the race and keeps the blood pressure down.

VikingsGuy

Well-known member

Lots of very fancy Ivy League studies support the common sense wisdom of LopeHunter’s post. “Beating the market” over a period of 10yrs is a fool’s game unless you have an “in”. YMMVI am for the most part a 3-fund guy that buys, holds and reinvests equites and bonds. I have about 10% in individual stocks, though, and again those equites are buy and hold. I began holding bonds (BND) as a part of my portfolio only in last 3 to 5 years. Before that was 100% equities (mostly VTI) but am now knocking on age 60's door so holding some bonds along with real estate seems prudent.

All the research I encountered as an undergrad in the 1980s and grad school in the 1990s backed up the rule of thumb you can beat the return on the whole stock market but you can't do so year after year after year unless have insider info or are the exception that proves the rule. Think of actively trading as Vegas. If 1000 of us go to Vegas with $100,000 to play slots then only a small number, likely under 50, will have doubled our money and several of us will be in negative territory. More than likely several of the ones that doubled their money hit a jackpot early on and stopped at that point rather than churn the money back through the system a few times. Just look at fund managers and compare their most recent year vs VTI. More that half fall short. Of those that out-performed VTI then if they have a 5-year return then compare to VTI, net of fees of course. Most will not have 5 years of history as the manager though because the losers get canned or the investment company will shut down the fund and open a nearly identical one so the slate is clean rather than show came up short the past several years. These are the games played to get you to seek out actively-managed funds rather than go with low-fee VTI, BND, etc passive funds.

I hope you have a system that does very well for you. I play the odds and passive investing in a small number of big-bucket funds with very, very low annual fees and almost no commissions or short-term tax consequences has enabled me to double my money about every 8 years, multiple times. Getting an early start on saving is a factor that is often underappreciated.

Playing the market or chasing bitcoin and oil futures, etc, often relies on a look in the rear view mirror to craft the next investment trade but that is a risky strategy as the markets move not just on supply and demand but also by human psychological knee-jerk reactions and actual manipulation by major players which never can be fully built into a trading scheme.

I have a buddy that flipped houses about 20 years ago and in comparison I looked like the tortoise with my 5% and 8% returns during years he was doubling his money or better. He rolled over his gains in equity after each successful flip to buy bigger homes to flip and more homes to flip. He was swinging for the fences while I was tapping out bunts. His wife loved him. His mother-in-law loved him and handed him the bulk of her savings. The housing market crapped out and he went bankrupt while having 7 homes on the ocean in SoCal. He owned none of those and putting renters in the units he could not sell as were under water would not cover the cash flow needed to stay afloat. Oh, the mother-in-law and wife no longer loved him.

This same buddy told me he is now trading bitcoin and similar items these days. He is making a killing per him. I am an idiot per him. He may be correct re me being an idiot. I know I sleep very, very well and owe not one cent to anyone on my two homes and am very happy with my investment account balances. I have the same wife I had decades ago. I am told stress kills. I have less stress than my buddy now and for the past few decades. I like being the idiot.

Last edited:

SAJ-99

Well-known member

Do any of the investors/traders want to share their annual returns over long term periods? Not just some one time wins? I know a guy that is a bond trader for a large investment bank. Makes obscene amounts of salary/bonuses for his job. His personal trading/investment account average returns were quite a bit below index fund averages. When I saw that he wasn't able to make a decent return it made me think what a waste of time/effort for me to try.

I like to keep the majority of our funds in VTSAX. I'll call myself a full time investor for purposes of this thread. https://investor.vanguard.com/mutual-funds/profile/VTSAX

10 yr annual return 13%. 6.78% since 2000.

VTSAX is a passive fund trying to match the US stock market. The best benchmark is probably the Russell 3000, which had a 10yr annualized return of 13.41% as of November 30.

All investors have different risk tolerances, so any comparison of returns is not very useful. You are 100% stocks, I might be 60/40 stocks/bonds. People have to figure out how much risk they can endure, and time has a lot to do with that. Passive funds are the way to go, dollar-cost average by putting money in at specific periodic times, and don't look at it except once per year to rebalance back to target weights. Oh, and don't let a financial advisor charge you 1% to do that. find one that is a flat-fee advisor and make sure they have some credentials. I know most corporate 401K programs still have quite a few actively managed mutual funds. The concept is still incredibly seductive, even if the data says it is a money-losing proposition.

Tradewind

Well-known member

- Joined

- Aug 19, 2015

- Messages

- 5,174

I am for the most part a 3-fund guy that buys, holds and reinvests equites and bonds. I have about 10% in individual stocks, though, and again those equites are buy and hold. I began holding bonds (BND) as a part of my portfolio only in last 3 to 5 years. Before that was 100% equities (mostly VTI) but am now knocking on age 60's door so holding some bonds along with real estate seems prudent.

All the research I encountered as an undergrad in the 1980s and grad school in the 1990s backed up the rule of thumb you can beat the return on the whole stock market but you can't do so year after year after year unless have insider info or are the exception that proves the rule. Think of actively trading as Vegas. If 1000 of us go to Vegas with $100,000 to play slots then only a small number, likely under 50, will have doubled our money and several of us will be in negative territory. More than likely several of the ones that doubled their money hit a jackpot early on and stopped at that point rather than churn the money back through the system a few times. Just look at fund managers and compare their most recent year vs VTI. More that half fall short. Of those that out-performed VTI then if they have a 5-year return then compare to VTI, net of fees of course. Most will not have 5 years of history as the manager though because the losers get canned or the investment company will shut down the fund and open a nearly identical one so the slate is clean rather than show came up short the past several years. These are the games played to get you to seek out actively-managed funds rather than go with low-fee VTI, BND, etc passive funds.

I hope you have a system that does very well for you. I play the odds and passive investing in a small number of big-bucket funds with very, very low annual fees and almost no commissions or short-term tax consequences has enabled me to double my money about every 8 years, multiple times. Getting an early start on saving is a factor that is often underappreciated.

Playing the market or chasing bitcoin and oil futures, etc, often relies on a look in the rear view mirror to craft the next investment trade but that is a risky strategy as the markets move not just on supply and demand but also by human psychological knee-jerk reactions and actual manipulation by major players which never can be fully built into a trading scheme.

I have a buddy that flipped houses about 20 years ago and in comparison I looked like the tortoise with my 5% and 8% returns during years he was doubling his money or better. He rolled over his gains in equity after each successful flip to buy bigger homes to flip and more homes to flip. He was swinging for the fences while I was tapping out bunts. His wife loved him. His mother-in-law loved him and handed him the bulk of her savings. The housing market crapped out and he went bankrupt while having 7 homes on the ocean in SoCal. He owned none of those and putting renters in the units he could not sell as were under water would not cover the cash flow needed to stay afloat. Oh, the mother-in-law and wife no longer loved him.

This same buddy told me he is now trading bitcoin and similar items these days. He is making a killing per him. I am an idiot per him. He may be correct re me being an idiot. I know I sleep very, very well and owe not one cent to anyone on my two homes and am very happy with my investment account balances. I have the same wife I had decades ago. I am told stress kills. I have less stress than my buddy now and for the past few decades. I like being the idiot.

Nothing worse than when that joyride stops going up, eh.

Similar threads

- Replies

- 43

- Views

- 5K

- Replies

- 7

- Views

- 1K